Ga take home pay

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Georgia Hourly Paycheck Calculator.

1955 Home Turf Neighborhood Korean Words Korean Words Learning Learn Korean

This free easy to use payroll calculator will calculate your take home pay.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. For 2022 the minimum wage in Georgia is 725 per hour. How to calculate annual income.

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. Just enter the wages tax withholdings and other information required.

California also has a low take-home pay rate due in part to having the nations highest income tax rate. Below are your Georgia salary paycheck results. It can also be used to help fill steps 3 and 4 of a W-4 form.

Your average tax rate is 1454 and your marginal tax rate is. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay. This is your actual take-home pay if you make 200000 in Georgia.

If you make 94000 a year living in the region of Georgia USA you will be taxed 18653. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Georgias top state income tax rate of 6 percent kicks in after just 7000 in earnings for single filers or 10000 for joint filers.

Georgia Salary Calculation - Single in 2022 Tax Year. Georgia Income Tax Calculator 2021. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Supports hourly salary income and multiple pay frequencies. For example if an employee earns 1500. Some states follow the federal tax.

Well do the math for youall you need to do is enter. The Huskers are now. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. In Georgia taxpayers can claim a standard deduction of 4600 for single filers and 6000 for joint filers. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The latest budget information from April 2022 is used to. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. While Georgia has one of the lowest.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Salary Calculation for 65k.

16 hours agoThe Cornhuskers fell 45-42 against Georgia Southern on Saturday allowing an 8-yard touchdown with 36 seconds left to fall to 1-2 on the season. Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1. Georgia Salary Paycheck Calculator.

The state tax year is also 12 months but it differs from state to state. The results are broken up into three sections. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Blog Robby Cuthbert Design Magazine Layout Design Design Ceramic Growler

How Much You Must Earn To Afford A House In The 50 Largest U S Cities Rits Map Home Buying City

Never Pay For Covered Home Repairs Again Save 50 Limited Time Home Repairs Repair Service Kitchen

Our 11 X 17 Size Recycling Poster Ronald Mcdonald House Charities Pop Tabs Ronald Mcdonald House

13 Legitimate Work From Home Jobs In Georgia Work From Home Jobs Legitimate Work From Home Home Jobs

5 Excellent Kennesaw Georgia House Buying Tips You Must Know Infographic Home Buying Kennesaw Kennesaw Georgia

Pin By Muhammad Sumitra On Slip Gaji Nama Transportasi

Pay Dirt Cake Recipe Dirt Cake Desserts Pudding Flavors

Bring The Kids For The Finart Program Photos Courtesy Of Blue Pelican Money Smart Family Money Smart Week Financial Education

Income Inequality In The Us How Much More The Top 1 Makes Compared To Everybody Else Vivid Maps Map Inequality Everybody Else

Amazing Scapes More Inc Serving Gwinnett And Surrounding Area For All Your Residential Commercial Landscape Needs 678 7 Free Quotes Scape North Georgia

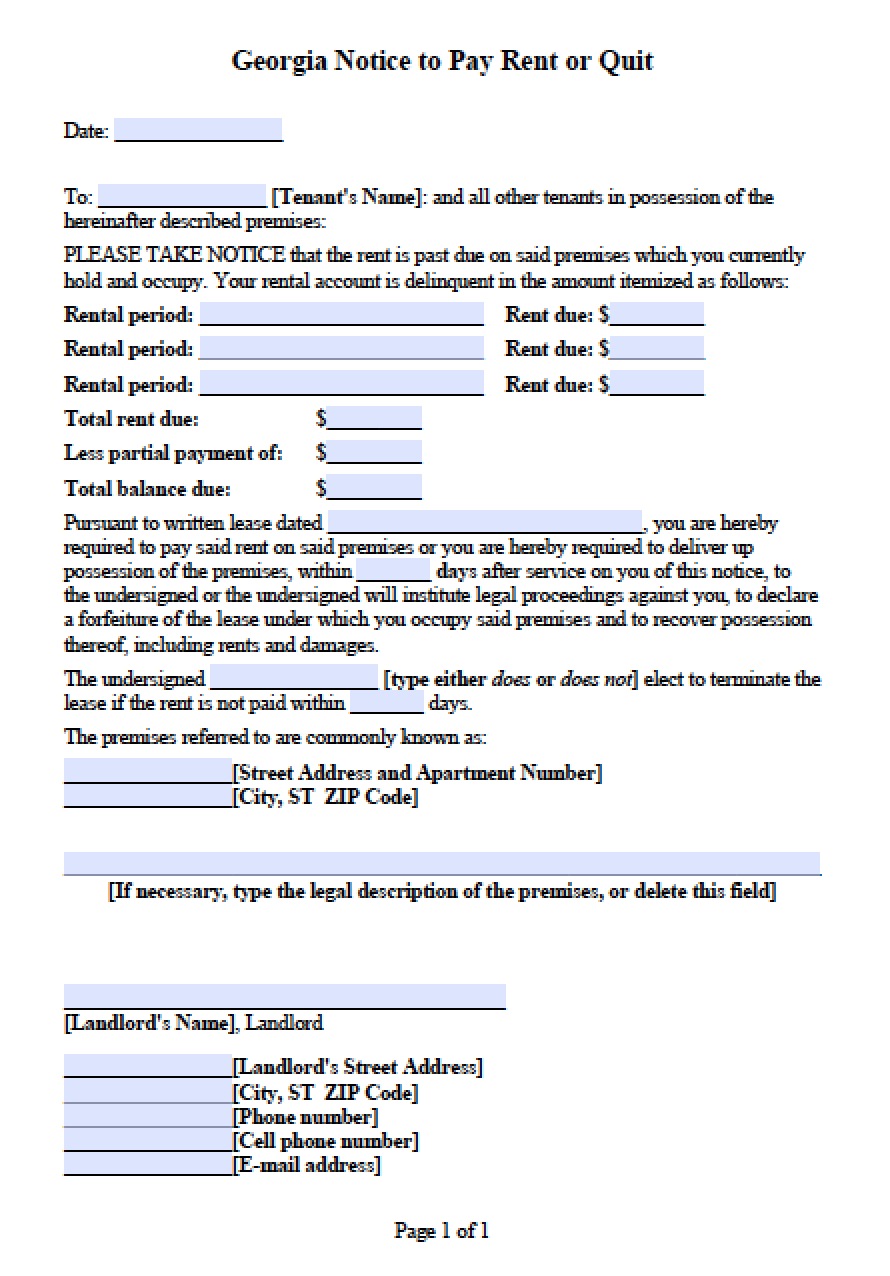

Eviction Notice Late Rent Notice Rent

Weekly Fluency Short Vowel Mini Books Preschool Reading Mini Books Language Arts Lessons

Payday Instant Printable Stickers Colorful Payday Instant Etsy Australia Printable Stickers Printable Planner Stickers Instant Download Stickers

Types Of Traffic Violations Consequences And It S Penalties Traffic Violations License Suspension

15 Best Flea Markets In Georgia Best Vacations Fleas Paris Travel

Pin On Best Of Hearmefolks Make Money Online